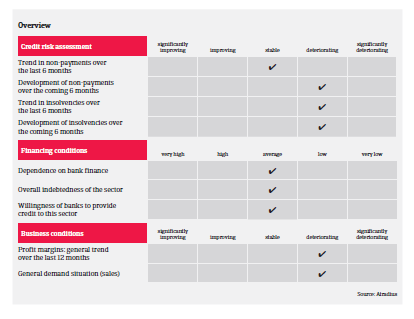

Small basic component parts producers often suffer from poor equity, while at the same time they face increasing difficulties obtaining bank finance.

- Higher credit risk due to sales slowdown

- The Sino-US trade dispute has an impact

- Payments take 90-120 days on average

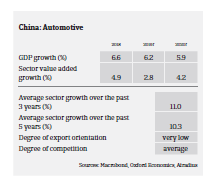

While the Chinese car market is expected to rebound in the long-term, currently sales are sharply declining and the credit risk situation in some segments has deteriorated. This has triggered a downgrade in our sector performance outlook.

For the time being, the direct effects on the Chinese automotive industry of the of the ongoing trade dispute with the US have been rather low. In total, vehicle import and export volumes accounted for just 4.1% and 4.6% of China´s automotive output in 2018.

However, the indirect consequences of the Sino-US trade dispute (lower economic growth, increased insecurity of businesses and consumers) have a substantial impact on the Chinese car market. After several years of high growth, domestic vehicle sales decreased 2.8% year-on-year in 2018 and even declined 12.4% in H1 of 2019. This downward trend is expected to continue in H2 of 2019 and in early 2020.

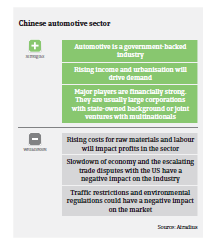

Despite the current sales deterioration we still see original equipment manufacturers (OEM) as strong businesses, due to high capital levels, advanced technical capacities and the long-term growth potential of the Chinese automotive market. The same accounts for core part (Tier 1) suppliers, which are highly integrated into the supply chains of OEMs.

However the situation is more difficult for the basic component parts (Tier 2) subsector. Smaller and/or private-owned companies in this segment often suffer from poor equity, while at the same time they face increasing difficulties obtaining bank finance. More payment delays and higher insolvencies are likely in this segment due to the current market slowdown and decreasing profit margins for smaller companies.

Given the ongoing sales slump it comes as no surprise that car dealers are having a difficult time, with more than 50% of them suffering losses in 2018. Due to this and fierce competition in this segment we expect and increasing number of small-sized car dealers to close their business in the coming 12 months.

E-mobility segment – more suppliers facing insolvency

In contrast to the combustion engine segment the electrical car sector (currently with a 5% market share) continues to grow. Sales rose 62%, year-on-year, in 2018 (to about 1,256,000 units) and 50% in H1 of 2019. Over the last couple of years the government has provided substantial subsidies to manufacturers of more than CNY 95 billion (EUR 12.3 billion), while customers have been offered tax incentives and favourable discounts for purchasing.

However, concerns over overcapacity have increased, as more and more carmakers and suppliers have entered the e-mobility segment, and with the opening of the market to overseas manufacturers competition becomes even fiercer. In order to show the market the Chinese government has raised the market entrance barriers in terms of capacity, investment scale and technology standards. At the same time subsidies will be gradually phased out, decreasing by over 50% in 2019 and expiring by the end of 2020.

Those measures will lead to the elimination of many smaller low-cost manufacturers that currently produce basic parts and have widely benefited from subsidies in the past. Only those suppliers with access to external funding and who are technically able to convert themselves into hi-tech companies with core competencies and constant R&D investment will survive in the mid-term. We expect that the number of insolvencies in this low-tech electrical car segment will increase by more than 5% in the coming 12 months.

Restrictive underwriting stance for car dealers

On average, it takes car manufacturers and suppliers about 90-120 days to collect debts. In the car dealers segment, average creditor days are about 40-60 days. Late payments are expected to increase in both the Tier 2 and car dealers segments in the coming 12 months.

While our underwriting strategy remains generally open for OEMs and Tier 1 suppliers, we are more cautious on manufacturers of domestic brands than we are to joint ventures. Given the issues in both the gas-powered and electric car segments mentioned above our underwriting stance for the Tier 2 segment is neutral to restrictive. Due to contracting sales, fierce competition and the, on average, small size of businesses, our underwriting stance for the car dealers segment is mostly restrictive. We expect automotive insolvencies to increase by about 5% in the coming 12 months.

As both the business performance (sharply decreasing sales) and the credit risk situation have deteriorated in H1 of 2019, we have recently downgraded the Chinese automotive performance forecast from “Fair” to “Poor”

Documents associés

1.19MB PDF