Business margins expected to increase again in 2022

Pharmaceuticals is one of the Switzerland´s major industries, accounting for about 7% of GDP, 35% of manufacturing and more than 8% of global production. In terms of production value, R&D expenditure in new drugs and healthcare technologies, in recent years, the Swiss pharmaceuticals business has been atop the rankings in Europe.

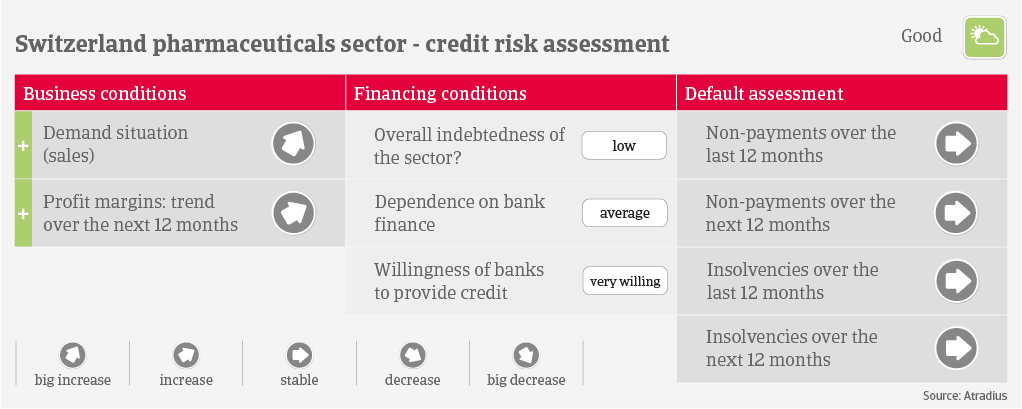

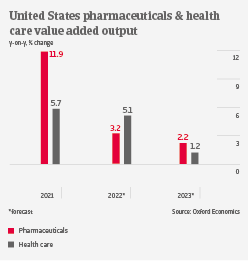

The highly export-dependent sector benefits from ongoing robust global demand, and pharmaceuticals value added output is forecast to grow more than 5% in 2022 and more than 4.5% in 2023. Margins of Swiss pharmaceutical businesses have increased in 2021, and we expect them to grow further this year. To date, supply chain disruptions (e.g. import of commodities and drug ingredients) have not been an issue. Many producers and suppliers of ingredients are an integral part of the supply chain for Covid-19 vaccines, tests, and disinfectants. In the domestic market, wholesalers and pharmacies benefit from ongoing demand for vaccinations and tests.

Increasing patent expiries will have an impact on margins of drug producers with high R&D expenses. However, this is somewhat mitigated by growing global demand for brand name drugs and new healthcare technologies. In the domestic market, Swiss consumers still prefer brand name to generic drugs, despite substantial price differences.

Most Swiss pharmaceutical businesses have good access to external financing sources, and show low gearing and robust financials. The payment duration is 90-120 days on average, but payment behaviour has been very good over the past two years. The number of both payment delays and insolvencies has been low over the past 12 months, and we do not expect an increase in 2022. Due to low credit risk, the robust demand situation and the financial strength of most businesses, our underwriting stance remains open for all segments.

Related Documents

969.0KB PDF