For many businesses both demand and profit margins are expected to deteriorate further, with a moderate rebound expected in H2 of 2020 at the earliest.

- Ongoing deterioration of demand and margins

- Increasing payment delays and insolvencies expected

- Payments take 105 days on average

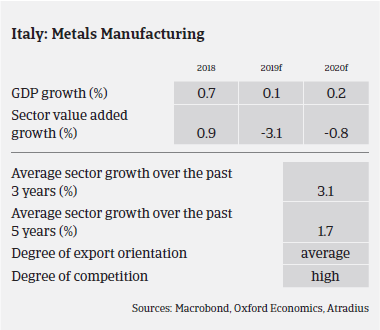

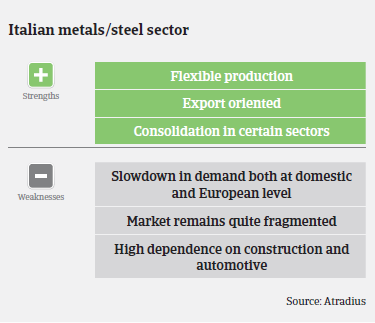

After three years of positive market development between 2016 and 2018, this year the business conditions for the Italian metals and steel industry have started to deteriorate. Demand for metals and steel products has slowed down, mainly due to the downturn in the automotive industry and the persistent difficulties in the domestic construction industry. At the same time, a slowdown in manufacturing activity in the EU and subdued investments due to elevated downside risks (e.g. Brexit, trade disputes) hamper the performance of export-oriented metals and steel businesses.

Another issue is higher steel imports to the EU from overseas producers, triggered by the ongoing US import tariffs. So far, steel producers have considered safeguard measures introduced by the European Commission insufficient. A “Carbon Border Adjustment” has been recently proposed to restore more equal trade competition with producers from countries with less strict environmental regulations.

Due to the mounting challenges, according to the World Steel Organisation Italian domestic raw steel production decreased 4.5% year-on-year between January and August 2019, and the iron and steel sector value added growth is expected to contract by about 4% this year, while steel prices have constantly decreased since Q4 of 2018.

For many Italian metals and steel businesses both demand and profit margins are expected to deteriorate further in the coming months, with a moderate rebound expected in H2 of 2020 at the earliest. While the payment experience has been good over the past two years and insolvencies have not increased, it is expected that both payment delays and business failures will increase in Q4 of 2019 and H1 of 2020 (up about 4%). Metals and steel businesses operating in the domestic market remain affected by slow payment from their customers as the average payment duration is 105 days, putting pressure on their cash flow.

Taking into account both the solid performance over the past two years, but also the current issues, our underwriting stance remains generally open to neutral, depending on the performance of the subsectors and their main buyer industries. We are more open to metals and steel producers and companies that are export-oriented, while more caution is advised for metals and steel distributors and service centres dependent on automotive and construction. Many of those businesses are highly leveraged small and medium-sized companies with thin margins.

We closely observe the ongoing issue regarding the future of the Ilva steel plant. A sharp reduction of production or even a closure of the plant would severely affect Italian steel output (Ilva´s production accounts for 1.4% of Italian GDP). In such a case Italian steel distributors and service centres would have to purchase raw steel from abroad, leading to higher costs and tighter payment terms. This would ultimately put additional pressure on (already tight) margins and working capital of Italian steel buyers.

Related Documents

1.06MB PDF