More insolvencies expected in the coming months

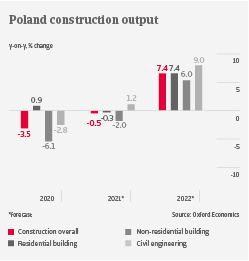

After a 3.5% contraction last year, Polish construction output is forecast to level off in 2021, but then to rebound by more than 7% in 2022. Apart from warehousing and transport-related building projects, commercial construction is performing poorly, as investment in office buildings remains subdued. Civil engineering is set to grow, but the current dispute between the EU and Poland over rule of law issues is putting a disbursement of EUR 36 billion from the Next Generation EU fund at risk. That said, the outlook for residential construction is more positive, as demand continues to exceed supply.

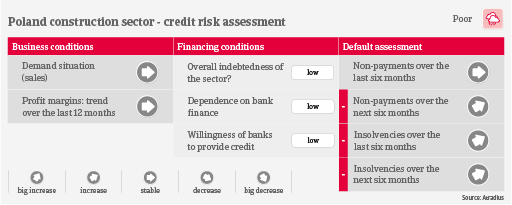

While profit margins of construction businesses remained stable in 2020 and H1 of 2021, they are expected to deteriorate in the coming months, due to higher prices for construction materials and increasing labour costs.

Payments in the Polish construction industry take 83 days on average. Payment behaviour has been rather bad over the past two years, and overdue payments of up to 30 days are common. The sector is prone to payment delays, as there are many disputes related to quality and scope of work. Payment delays suffered by a company are usually passed on to peers along the value chain.

In H1 of 2021 the number of construction insolvencies increased sharply year-on-year, mainly due to a high rate of simplified out-of-court restructuring proceedings. In the coming six months, business failures are expected to increase further, as government support schemes expire, pandemic-related aid has to be repaid, and the liquidity of businesses remains strained by higher costs for materials and wages. Most vulnerable are companies that have a low level of diversification in their work portfolio, and that are focused on infrastructure and/or office/hotel buildings. Our underwriting stance remains neutral for residential construction, but rather selective for businesses active in the non-residential and civil engineering segments, depending on their individual situation.

Related Documents

1.06MB PDF